January 2025

I am yet to come across a client who is excited to pay Revenue Canada their hard earned money.

That being said, I have lots of clients who either don’t understand how their assets are taxed when they pass away or choose to put their head in the sand and ignore the tax issues because “its not their problem or their kids will get enough.” So lets first start and understand how your assets are taxed when you pass away then we will look at how to avoid paying tax.

DO YOU HAVE A WILL?

If you have a will, then you have answered how your assets are to be distributed. If you die without a will, than your estate will be distributed according to Ontario’s Succession Law Reform Act which means you don’t control the outcome. A few things to think about here.

Without a will…

- Assets. Your closest relatives will inherit your assets. If you’re legally married, your spouse will receive the first $200,000 and a portion thereafter depending on how many children you have. If you have no children, your spouse will inherit everything.

- No Automatic Executor: No one will automatically have the right to be the executor of your estate. Your closest relative will need to apply to the court to be appointed as the estate trustee.

- Common-law Spouses: Common-law spouses do not automatically inherit your assets. They may need to prove their dependency to receive anything from your estate.

- Guardianship of Minor Children: The court will decide who will be the guardian of your minor children, which might not be who you would have chosen.

- Estate Administration Tax: There is a tax on the total value of your estate. For estates over $50,000, the tax is approximately 1.5% of the estate’s value.

- Charities: No portion of your estate will go to charities unless specified in a will

- Government: If you have no next-of-kin, your entire estate will go to the Ontario government.

HOW ARE YOUR ASSETS TAXED WHEN YOU PASS AWAY?

In general, as of 2025, here is how assets are taxed when you pass away.

- Registered Retirement Accounts (RRSP, RRIF, etc.): The entire value of a RRSP/RRIF is taxed as income to the deceased before the net proceeds are then transferred to the designated beneficiary(ies). The highest marginal tax rate in Ontario is 53.53%.

- Non-Registered Investments and secondary properties (rental units, cottage etc.): Unrealized capital gains are taxed. The highest marginal tax rate in Ontario is 53.53%.

- Tax Free Savings Account (TFSA): The full market value of the account is distributed tax free to any designated beneficiaries on the account. If not, beneficiaries are designated, then the proceeds pay tax-free to the deceased’s estate but may be subject to probate fees (~1.5% in Ontario).

- Primary Residence: The family home will be distributed tax free through the estate, aside from probate fees (~1.5%)

Are you an incorporated professional? If so you owe a lot more in tax.

Incorporation is good while you are accumulating assets as your corporate tax rate is low. However when you pass away there are significant tax issues on the shares of your private corporation. When you and your spouse pass away and the corporate assets are sold and distributed, there are up to 3 levels of taxation that may occur.

Tax 1 – Shareholders’ terminal tax return – Deemed disposition of shares of the corporation. Assuming you pass away with investments in your corporation, the value of these investments is now subject to capital gains tax with a cost base of $1.For example, if you have $1M in investments in your corporation, your shares are deemed to be worth $1M and are taxed accordingly.

Tax 2- Capital gains tax on the sale of corporate investments.

For the beneficiaries to receive their portion of the corporation’s investments, these investments must be sold. This disposition results in a taxable capital gain. The capital gain is taxable at the corporate investment income rate of 50.17%. Part of the taxable capital gains will be recovered as RDTOH. The other part is added to the capital dividend account and can be distributed tax free.

Tax 3 – Dividend tax on distribution of assets out to your heirs.

When proceeds inside of a corporation are distributed to heirs, they are distributed as dividends. If the corporation has a capital dividend account balance, then tax-free capital dividends may be paid to heirs. The remainder of assets (usually the majority of corporate assets) are paid out as taxable ineligible dividends. The ineligible dividends are taxable in the hands of the heirs who receive them at their respective marginal tax rate (53.53% is the highest tax rate in Ontario).

When an individual owns shares in a private corporation, post-mortem planning can reduce or elimination double taxation that can result from the deemed disposition of shares and the tax liability on the final distribution of assets out of the corporation. In the end, there is at least capital gains on the shares of the corporation.

WANT TO REDUCE YOUR TAX BILL?

If you do some planning then you can reduce or avoid paying tax.

What asset flows tax free to a corporation and is paid out tax efficiently?

Life insurance. Life insurance is paid to the corporation tax free and can be paid out tax efficiently to your heirs through the corporate capital dividend account. The capital dividend account (CDA) is a notional account created in the income tax act section 89(1). CDA balances can be distributed to shareholders as a tax-free capital dividend. At any time, a balance exists, a corporation can declare a capital dividend which will allow the proceeds, up to the CDA’s balance, to flow to the corporation’s shareholders (in the case of life insurance, most likely the estate) tax-free.

COMMON MISCONCEPTIONS OF WEALTHY INDIVIDUALS WITH LIFE INSURANCE

- I don’t need life insurance.

True. If you have enough money in assets to protect your family you don’t need life insurance for income replacement but there are other reasons to own life insurance.

Once you understand how your assets are taxed and how much you will lose to tax, you should look at life insurance as a tool to pay your tax bill or an investment that is guaranteed and has a great rate of return when you pass away. This is effective estate planning. - My kids will get enough.

True. If you have built up significant assets these will eventually be transferred to your heirs. However, have you calculated how much of those assets disappear to tax? Even if there is more then enough for your kids, if you don’t insure your tax issues, you are actually saying to your loved ones, you would much rather more money go to Revenue Canada instead of to them. We don’t have many clients who love CRA that much 🙂 - I am too old to get insurance and its expensive.

Clients up to age 85 are eligible for insurance. When a client tells us its too expensive, they are looking insurance like as an expense. Life insurance is not an expense, its an asset that is guaranteed to pay out and if you look at it as any other investment the rate of return is excellent.

The math

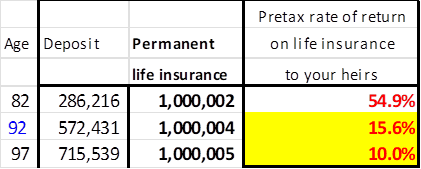

I have a couple both age 72, who are looking at their estate issues. They have a tax liability of $2M on their corporate real estate and investment portfolio. They have $1M of joint last to die corporate owned life insurance. Each $1M of permanent joint life insurance costs $28,620/year. Assuming they live another 20-25 years, here is the rate of return they would have to earn in any other corporate investment to have the same after tax funds paid out to their heirs.

- If they had invested the same funds ($28,260/year) into any other corporate investment, to get back $1M tax-free in 20 years from now, they would have to earn 15.6% a year in any other investment.

- If they live 25 years (to age 97), the rate of return is 10%/year.

- Find me another asset with a similar guaranteed annual rate of return?

- This shows life insurance is not expensive and is an excellent asset for long term planning.

We are here to assist. If you want to review your insurance, please call or email.

To setup a call, please click on our link or call my direct line 416-512-3300

Elliott Levine, MBA, CFP at Levine Financial Group in Toronto

416-222-1311 I info@levinefinancialgroup.com