Most physicians are incorporated and save money inside their professional corporations. You may choose to invest in stocks, bonds, mutual funds, or whole life insurance depending on your appetite for risk, anticipated rate of return, liquidity, and appetite for paying tax (yes we did just say that). The purpose of this article is to help demystify whole life insurance as a savings, retirement and estate planning tool.

What is Whole Life Insurance?

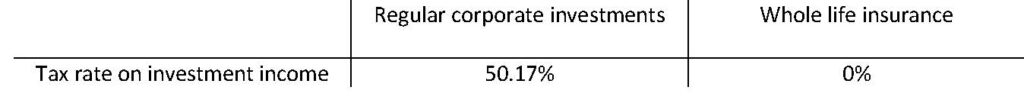

Whole life is classified by the Canada Revenue Agency (CRA) as a tax-exempt life insurance policy and is a non-passive investment. This means funds invested in a life insurance policy grow tax free whereas regular corporate investment income is subject to 50.17% tax.

How are the funds in a whole life portfolio invested?

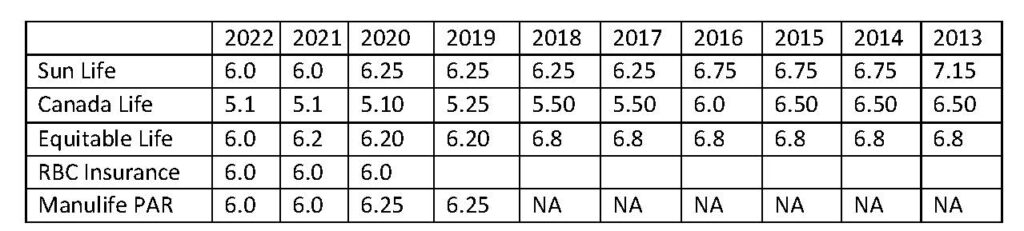

Different insurance companies invest differently which is why there is more volatility with some companies (measured by standard deviation) and higher dividend rates with others. For example, Sun Life is recognized for its private fixed income, real estate, and mortgage diversification whereas Canada Life and Manulife are heavily invested in government and corporate bonds compared to RBC which targets a split of 50% fixed income and 50% equities.

Below are the dividend scale interest rates as of 2022 for the top tiered insurance companies.

The whole life portfolio uses a smoothing process which amortizes gains/losses. By smoothing out market and interest rate changes, the impact of volatility and short-term fluctuations is decreased thereby providing a more stable return on all asset classes than if investment gains and losses had occurred. The result is a dividend scale interest rate that tends to fall more slowly than actual interest rates and equity markets. It also tends to increase more slowly when actual interest rates increase, or equity markets enter periods of growth.

What is the dividend scale interest rate?

The funds inside a whole life policy grow on a tax deferred basis and earn income related to the policy dividend scale interest rate. Dividends are credited on the anniversary of your policy based on the dividend interest rate at that time. Policy performance is affected by the design of the life insurance, the pattern of guaranteed cash values, the number of premiums paid to the policy and by the age and risk of the insured. On average, approximately 70% of policyholder dividends are attributable to investment experience and 30% is due to positive factors such as lapses, mortality, and expenses.

As a policyholder, you are eligible to receive dividends and you may choose how you want the dividend to be used. You have several options, the most popular of which is to purchase paid up additional insurance, you may choose to withdraw dividends as cash or leave the dividends on deposit in an account similar to a savings account which earns interest. Dividends credited to a policy have a cash value and are vested. Unlike stocks or bonds where portfolio values fluctuate, the vested dividends paid to your policy cannot be reduced regardless of future performance.

What is guaranteed in a whole life plan?

Policy values are guaranteed to grow each year. Every year once you receive a policy statement with your annual dividend distribution, the increased cash value and death benefit are vested and guaranteed at these new values providing you peace of mind with little volatility when compared to a traditional investment such as stocks, bonds, ETFs etc.

How has whole life insurance held up during severe economic events such as the 2008 financial crisis?

History repeats itself and investors tend to forget market events. Here are the facts. There have been 12 financial stress tests since 1929, with the most significant being the 2008 global financial crises. Financial crises begin with the belief that such events are a thing of the past, future recessions will be mild, housing prices will continue to grow and that the markets will remain liquid. This delusion of stability has in the past, led to overconfidence, unsustainable leverage, irrational expectations of investment returns and a higher aversion to risk on the part of investors. Financial crises cannot be anticipated or pre-empted because investor behavior is both irrational and unpredictable. There is no way to be sure exactly when a bubble will pop. As investors, it is imperative that we remember history has a way of repeating itself and part of prudent planning is to diversify accordingly.

Participating whole life insurance has held up for 150 years because it is not based upon stock market returns, the latest fad or consumer hype. Unlike a traditional stock/bond portfolio which collapsed under market strain, participating whole life is guaranteed to increase in value and has paid a dividend during every economic stress test of the past 100 years including the 1929-1932 Depression and the 2008 Global Financial Crisis. As an asset class, this is a proven performer.

So now that I understand how whole life works, what can it do for me?

Tax free growth using corporate dollars.

During your income earning years accumulating cash in a whole life policy is a tax efficient means to build up capital for retirement as funds are guaranteed to grow, are not taxed inside a life insurance policy and every year you receive a statement and your dividend is paid, these values are vested and guaranteed. Compared to your other investments which are taxed at 50.17% and fluctuate in value, whole life insurance is a conservative place to put some corporate dollars.

EXAMPLE:

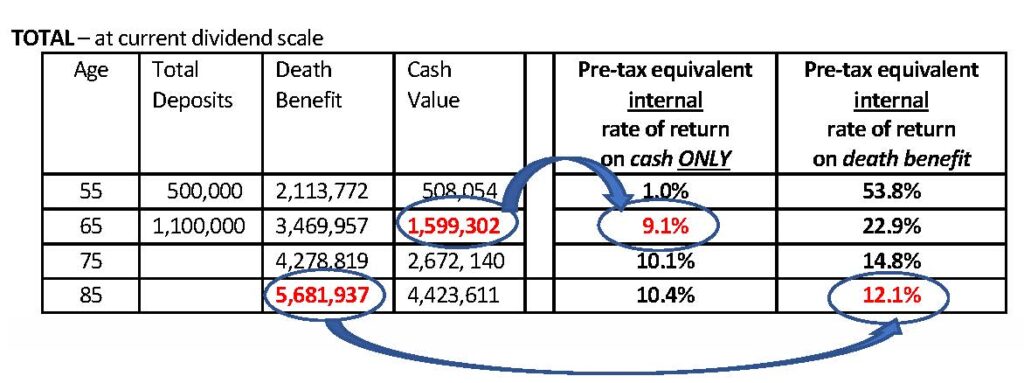

Dr. Brown is 45 and she invests $50,000 into a participating whole life insurance policy. Her policy is designed for maximum long-term growth. At the current dividend rate of 6%, here is how her policy performs.

At retirement (age 65)

Dr. Brown can access the cash value of her insurance tax free (1,6M). If she had invested $50,000 per year in any other investment, in order to have $1,6M after tax, she would have to earn a pre-tax annual rate of return of 9.1% plus she has life insurance.

As an estate planning tool (age 85)

Assuming Dr. Brown passes at age 85, her estate will receive $5.7M tax free. If she had invested $50,000 per year in any other investment, she would have to earn a pre-tax annual rate of return of 12.1%.

How can I access the cash value in my whole life insurance?

There are four ways to access the cash value in your policy; a policy loan, a cash withdrawal, selling paid up additions or a loan from a financial institution.

- Policy loan. Policy loans are easy to obtain and do not affect the growth of the policy. Loans up to the policy’s adjusted cost base (ACB) are tax free. Loans that exceed the ACB are taxable, but clients can deduct loan payments that repay the taxable portion. The insurer will issue a T5 for taxable gains. A policy loan will reduce the death benefit and ACB of a policy. If a policy loan is outstanding at the time of death, the policy’s Capital Dividend Account (CDA) will be reduced accordingly.

- Cash withdrawal/Partial Surrender. Your policy has a cash value and is there to be taken out if need be. Withdrawals of the cash surrender value (CSV) greater than the ACB are taxable on a pro rata basis to the ACB. Withdraw of funds up to the ACB is essentially a return of your capital less the cost of insurance. Once a withdrawal is made, it cannot be repaid.

- Cash in paid up additions. If you are using your policy to accumulate paid up additions (additional insurance), you may choose to cash in these paid-up additions and withdraw the value. Doing so will reduce the death benefit accordingly.

- Loan from a financial institution. As an alternative to a policy loan, you may choose to obtain a collateral loan where you pledge the insurance as collateral to secure a loan tax free. Unlike a policy loan, third-party loans do not create income and typically do not affect the policy CDA at the time of death. Under today’s tax rules, the loan is tax free, and the interest may be deductible if the loan is invested and generates income. The policy owner is required to pay interest and may choose to either capitalize the loan or pay the interest each year. We recommend paying the interest on the loan, so the loan balance does not increase. The interest rate is based on your personal credit rate. While tax laws change overtime, we are assuming current rules pertaining to loans, interest deductibility and life insurance policies. In order to reduce the risk of leveraging, it is prudent to assume a conservative return with the assets used to generate income, the interest rate on the loan and the dividend scale interest rate as these will vary in the future. Mortality risk can be managed by projecting life expectancy if you use age 100. The assumption on future interest rates and the spread between the policy dividend interest rate should also be manage accordingly. Financial institutions may require ongoing financial evidence to maintain a loan. As per CRA document 9606425 (April 1996), the pledging or assignment of a life insurance policy as collateral for a loan from the insurer, or a corporation related to the insurer, would not, by itself cause us (CRA) to conclude that a policy loan has been made therefore we recommend proper documentation in your files when you setup the loan.

Can your corporation own and pay for the insurance?

YES. An advantage of corporate owned life insurance is that the corporate tax rate is usually lower than the shareholder’s marginal tax rate; there is typically a cost advantage to having the corporation own the policy and pay the insurance premium.

Is a corporate owned life insurance policy taxed when I pass away?

NO. Upon your death, the corporation receives the proceeds of the life insurance, and will credit its “capital dividend account” by an amount equal to the proceeds less the policy’s adjusted cost base. The corporation is then able to declare a capital dividend, which will allow the proceeds in the corporation’s capital dividend account to flow to the corporation’s shareholders. The shareholders, who may be your estate, your spouse and/or your children, are not taxed on the receipt of a capital dividend.

If life insurance flows through my corporation tax free when I pass away,

what about my other corporate investments?

As corporate investments are generally the last to be sold, most clients’ pass away with investments inside their corporation. Generally, when the shareholder of the corporation dies and is survived by their spouse, the corporate shares can be transferred to a spouse or spousal trust tax-free. When you and your spouse pass away and the corporate assets are sold and distributed (i.e., to your children), there are up to 3 levels of taxation that may occur.

Personal capital gain on the deemed disposition of shares of the corporation.

The corporation was setup with a value of $1. The deemed value of the corporation’s shares at the time of death is the fair market value of the corporate investments which will be taxed as a capital gain as the shares are deemed to have been disposed.

Corporate tax on the sale of corporate investments.

For the beneficiaries to receive their portion of the corporation’s investments, these investments must be sold. This disposition results in a taxable capital gain.

Dividend tax on distribution of assets out to your heirs.

When the investments are sold and cash is distributed to your heirs, this distribution is a taxable dividend at the heirs’ personal tax rate on non-eligible dividend income from private corporations.

EXAMPLE

Let’s assume you have $3,000,000 in corporate investments with a cost base of $2,000,000 when you and your spouse pass away, and the assets are distributed to your heirs (children).

- TAX ON YOUR CORPORATE SHARES

The corporation was setup with a value of $1. The deemed value of the corporation’s shares at the time of death is the fair market value of the corporate investments (less the $1 adjusted cost base for the shares) which will be taxed as a capital gain. The shares are worth $3,000,000 and will result in a capital gain tax of $805,680. - TAX ON THE CORPORATIONS’ INVESTMENT GAINS

Once the investments owned by the corporation (stocks, bonds, mutual funds) are sold, there is capital gains tax on these investments. Assuming the cost base of the corporation’s investments is $2,000,000, there will be a capital gain of $1,000,000. Passive investment income for Canadian Private Corporations is taxed at 50.17% which results in corporate tax on the investment gains of $251,703 - TAX ON THE ASSET DISTRIBUTION TO YOUR HEIRS

When the investments are sold and assets are ultimately distributed to your heirs (i.e., your children), the distribution of these assets will likely be done at least in-part as a taxable dividend at the heirs’ personal tax rate on dividend income. If so, the payment of taxable dividends will trigger a dividend refund from the Corporation’s RDTOH account. The highest tax rate on personal dividend income is 47.74% which would result in tax of approximately $1,147,607.

Of the $3,000,000, your heirs will inherit only $795,010 after tax

The amount of tax payable will depend on the type of post-mortem planning that is done and whether or not there are planning tools available at the time you and your spouse pass away. For example, loss carry back planning, pipeline planning, a transfer of shares and then liquidation of assets or a combination of these strategies may be useful if they are available.

What can you do to reduce estate tax?

EXAMPLE

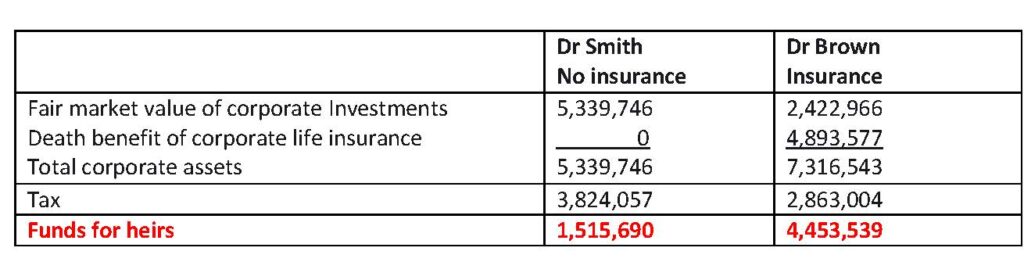

Let’s look at two physicians. Dr. Smith and Dr. Brown are 45-year-old incorporated physicians. Each earns $750,000 in their corporation and has no mortgage. They both have $500,000 in RSPs and $500,000 in corporate investments where they invest $150,000 a year and earn a 6% return. Both plan to retire at 70 and will each have a retirement income of $415,000 indexed to inflation.

What sets them apart is how they invest their corporate funds

Dr. Smith invests his $150,000 a year in a diversified investment portfolio. He believed in buying term while his family was young and investing the difference. At age 70, he feels he no longer needs life insurance. From the perspective of family protection, he is correct. However, he is ignoring estate issues. At age 70, he will have $3.9M in his RSP and $6.4M in his corporate investment portfolio and no insurance.

Dr. Brown invests her $150,000 by putting $100,000 into the same diversified portfolio and $50,000 into a participating whole life insurance policy. At age 70, she will also have $3.9M in her RSP, $6.6M in cashable assets ($4.5M in corporate investments, $2.1M in cash in her participating insurance policy) and life insurance of $3.8M

Who is better off?

During their working years

Dr. Smith has more in his corporate investment portfolio but has also paid 50.17% tax on the growth of his investment portfolio.

Dr. Brown pays has less in corporate investments but has paid less tax as the funds in her participating whole life insurance grow tax-free.

During retirement

Both have an identical retirement income of $450K per year indexed to inflation which means they were able to lead identical lifestyles.

When they pass away

Lets assume they and their spouses pass away at age 85 and want the funds in the corporation to roll tax efficiently to their heirs. The difference is how regular corporate investments vs life insurance are taxed once they roll out of the corporation to their heirs (children).

Life insurance flows tax free to your heirs; other investments are heavily taxed

IMPLICATIONS

IMPLICATIONS

Dr. Brown focused on accumulating assets tax efficiently, minimizing tax and using the tax-preferred treatment of life insurance to enhance her estate which resulted in her far more efficient estate distribution after tax.

Who do you want to inherit your money – Revenue Canada or your heirs?

IN CONCLUSION

While you are accumulating assets, whole life insurance is a conservative asset class that is not subject to tax on the investment growth and is guaranteed to grow each and every year. As you are paid dividends on the anniversary date of your policy, your cash value and death benefit grow and are vested (guaranteed). When you want to access the cash value in your policy (i.e. at retirement), you can do so tax efficiently. From an estate planning perspective, life insurance is flows through your corporation far more tax efficiently than any of your other corporate investments.

We hope that this has helped demystify whole life insurance. As a planning tool this can provide significant benefits to you during retirement and to your estate.

If you want to revisit your insurance, click here or email info@levinefinancialgroup.com

Elliott Levine, MBA, CFP is the President of Levine Financial Group in Toronto

We Save Physicians Money on their Insurance

416-222-1311 I info@levinefinancialgroup.com