Often clients tell us they don’t need life insurance for long term planning. What they are really telling us is that they don’t understand why they need life insurance for long term planning. So we thought it best to discuss the top misconceptions clients have on permanent life insurance.

- I have enough money to take care of my family so I no longer need insurance.

Some clients are fortunate to have saved well over their careers and no longer need insurance for income replacement. However, it also most likely means the reason for life insurance has changed to tax and estate planning. Lets look at how your assets are taxed when you and your spouse pass away.

- Registered assets (RRSP/RRIF) – The value of the RRSP/RRIF is taxed as income. The highest marginal tax rate is 53.53%

- Non-Registered Investments – Gains are subject to capital gains tax of 26.76%

- Vacation property/cottage – Gains are subject to capital gains tax of 26.76%

- TFSA – The value flows tax free.

- Primary residence – The family home flows tax free.

What about the shares of your corporation?

Generally, when the owner of the corporation dies (you) and is survived by their spouse, the shares can be transferred to a spouse or spousal trust tax-free. When you and your spouse both pass, there are several areas of taxation that apply.- Capital gain on the disposition of shares of the corporation. The corporation was setup with a share value of $1. The deemed value of the corporation at the time of death is at least the fair market value of these investments. This value will be taxed as a capital gain as the shares are deemed to have been disposed.

- Capital gains on the sale of investments owned by the corporation. Investment gains will be taxed when the investments are sold.

- Dividend tax on distribution of assets to the next generation. When the investments are sold and assets distributed, the distribution is a taxable dividend.

The amount of tax payable will ultimately depend on the type of post-mortem planning that is done and whether there are planning tools available at the time you and your spouse pass away to avoid double taxation on the liquidation of investments and dividend distribution to your heirs. Loss carry back planning, pipeline planning, a transfer of shares and liquidation of assets or a combination of these strategies may be useful if they are available at the time you and your spouse pass away. Assuming pipeline planning for example, the tax can essentially be reduced to capital gains tax on the shares. - Life insurance flows tax free to your spouse/heirs or corporation and can be used to fund the tax liability on your investments and shares of your corporation in addition to providing peace of mind for your family.

- My Investment guy told me I don’t need permanent life insurance.

Usually this means the investment professional doesn’t understand insurance and/or doesn’t understand how assets will be taxed down the road. See above and you have more than enough reasons to own some permanent life insurance for long term planning. If you look at this as an asset, the math always works (see below). - Life insurance is expensive.

When a client tells us its too expensive, they are looking insurance like as an expense. Life insurance is not an expense, its an asset so lets explore this like any other asset/investment.

The math

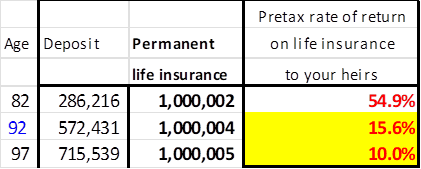

I have a couple both age 72, who are looking at their estate issues. They have a tax liability of $2M on their corporate real estate and investment portfolio. They have $1M of joint last to die corporate owned life insurance. Each $1M of permanent joint life insurance costs $28,620/year. Assuming they live another 20-25 years, here is the rate of return they would have to earn in any other corporate investment to have the same after tax funds paid out to their heirs.

- Assuming life expectancy of age 92, if you had invested the same premium in any other corporate investment, you would have to earn 15.6% a year. This shows you life insurance is an excellent investment for long term planning.

We are here to assist. If you want to review your insurance, please call or email.

CONTACT ME TO TO REVIEW MY INSURANCE.

Elliott Levine, MBA, CFP

416-222-1311 I info@levinefinancialgroup.com