Yesterday evening OMA Insurance had a seminar on estate planning using life insurance. This seminar focused on understanding how assets are taxed when you and your spouse pass away and how life insurance can be used as an asset accumulation tool to save and disburse funds tax efficiently through your corporation while alive and after you pass away. Below are our planning tips on tax and how to use insurance as an estate planning tool.

How are assets taxed when you pass away?

When you pass away, you are deemed by Revenue Canada to have sold all your assets at the fair market value. The Income Tax Act contains provisions to defer the tax owing if the asset is left to a surviving spouse or to a special trust for a spouse. In general, here is how assets are taxed as of 2024.

- Registered Retirement Accounts (RRSP, RRIF, etc.): The value of a RRSP/RRIF is taxed as income. The highest marginal tax rate in Ontario is 53%.

- Non-Registered Investments and secondary properties (rental units, cottage etc): Unrealized capital gains are taxed as follows: 50% of the first $250,000 of capital gains plus 67% of capital gains greater than $250,000 are taxed at your marginal tax rate. The highest marginal tax rate in Ontario is 53%.

- Tax Free Savings Account (TFSA): The full market value of the account is distributed tax free to any designated beneficiaries on the account.

- Primary Residence: The family home will be distributed tax free through the estate, aside from probate fees (~1.5%).

How are the shares of your corporation taxed?

Most physicians forget about tax on the shares of their private corporation. When you and your spouse pass away and the corporate assets are sold and distributed, there are up to 3 levels of taxation that may occur.

Tax 1 – Shareholders’ terminal tax return – Deemed disposition of shares of the corporation. Assuming you pass away with investments in your corporation, the value of these investments is now subject to capital gains tax with a cost base of $1.

67% of capital gains over $250,000 are taxed at your marginal tax rate (53.53% in Ontario).

For example, if you have $1M in investments in your corporation, your shares are deemed to be worth $1M and are taxed accordingly.

Tax 2- Capital gains tax on the sale of corporate investments.

For the beneficiaries to receive their portion of the corporation’s investments, these investments must be sold. This disposition results in a taxable capital gain. 67% of the capital gain is taxable at the corporate investment income rate of 50.17%. Part of the taxable capital gains will be recovered as RDTOH. The other part is added to the capital dividend account and can be distributed tax free.

Tax 3 – Dividend tax on distribution of assets out to your heirs.

When proceeds inside of a corporation are distributed to heirs, they are distributed as dividends. If the corporation has a CDA balance, then tax-free capital dividends may be paid to heirs. The remainder of assets (usually the majority of corporate assets) are paid out as taxable ineligible dividends. The ineligible dividends are taxable in the hands of the heirs who receive them at their respective marginal tax rate (53.53% is the highest tax rate in Ontario).

When an individual owns shares in a private corporation, post-mortem planning can reduce or elimination double taxation that can result from the deemed disposition of shares and the tax liability on the final distribution of assets out of the corporation. In the end, there is at least capital gains on the shares of the corporation. For example, if you have $1M in investments in your corporation, your shares are deemed to be worth $1M and are taxed accordingly.

How does life insurance work in a corporation?

Life insurance is paid to the corporation tax free and can be paid out tax efficiently to your heirs through the corporate capital dividend account. The capital dividend account (CDA) is a notional account created in the income tax act section 89(1). CDA balances can be distributed to shareholders as a tax-free capital dividend. At any time, a balance exists, a corporation can declare a capital dividend which will allow the proceeds, up to the CDA’s balance, to flow to the corporation’s shareholders (in the case of life insurance, most likely the estate) tax-free.

EXAMPLE

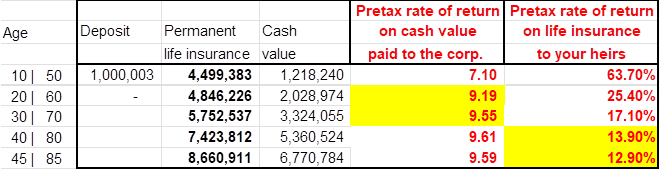

Dr. Smith is a specialist and saves over $250K a year in his corporation. He is 41, owns a home and a cottage has minimal debt and 5 kids. He is looking at insurance as a tool to save money for retirement and as an estate planning tool. In this case, he is going to contribute $100K a year for 10 years into a life insurance policy. Below are the numbers:

Implications:

Assuming he retires at age 60, he can access the cash value ($2M) tax free. If he had invested the same $100K/year for 10 years in any other investment in his corporation he would have to have earned a pretax annual rate of return of 9.2% .

Assuming he passes away at age 85, $8.6M is paid to the corporation tax free. If he had invested the same $100K/year for 10 years in any other investment in his corporation he would have to have earned pretax annual rate of return of 12.9%.

This shows life insurance is an excellent asset either as a tax planning tool for saving or as an estate planning tool for tax.

How can you access the funds from the life insurance during retirement?

There are four ways to access the cash value in your policy; a policy loan, a cash withdrawal, selling paid up additions or a loan from a financial institution. This is a common corporate retirement savings plan strategy. A corporate retirement strategy can be structured with either the corporation or shareholder borrowing against a corporate owned life insurance policy.

What is guaranteed in a whole life plan?

Each and every year as you get a policy statement these values are guaranteed. This means at the current dividend rate, unlike regular investments that fluctuate year by year, every year as your dividends are paid in, values are vested and guaranteed never to go down.

How does whole life reduce your corporate taxes?

Your regular corporate investments are subject to a tax rate of 50% and reduce your small business deduction. Participating insurance grows tax free and has no effect on your small business tax rate.

What happens to your corporation when you retire?

As physicians begin to consider retirement, they often inquire about the fate of their corporation and the assets within it upon their retirement. In general, the Ontario Business Corporations Act mandates the removal of the term ‘professional’ from your corporation’s name, as it ceases to be a professional corporation upon retirement. Subsequently, you will deregister the corporation and transition your Medicine Professional Corporation to a holding company. Transitioning to a holding corporation post-retirement can offer additional tax planning benefits, including income splitting and access to lower tax rates for you and your spouse. With respect to your life insurance, if the name of your corporation has changed, it is prudent to update the life insurance policy to reflect the new corporate name as the owner and beneficiary. As for tax consequences associated with a change in the owner and beneficiary of your life insurance, generally, a name change in the corporate name does not trigger any tax implications because there is no transfer of ownership to a new entity; the corporation remains the same despite the name change.

We are here to assist. If you want to review your insurance, please call or email.

CONTACT ME TO TO REVIEW MY INSURANCE.

Elliott Levine, MBA, CFP

416-222-1311 I info@levinefinancialgroup.com

Levine Financial Group is not part of the OMA, we are an independent insurance advisory firm.